Release by HMRC of EU to GB Importer information in 2022

This section is News

The HMRC importer details facility will be extended in March 2022 to include importer’s details for any business that is UK VAT and or EORI registered and imports goods from the EU to GB.

UK VAT and EORI registered importer information

The HMRC importer details facility will be extended in March 2022 to include importer’s details for any business that is UK VAT and or EORI registered and imports goods from the EU to GB.

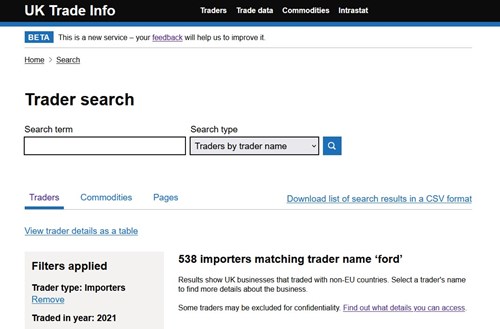

HM Revenue and Customs (HMRC) already publishes importer information for UK trade with non-EU countries. From 11th March 2022 the importer details published on www.uktradeinfo.com will be extended to include importer’s details for any business who is UK VAT and or EORI registered and imports goods from EU to GB.

The publication of these details aims to provide better services to businesses. This information note sets out what HMRC will publish, why it is important to trade, what is not published and how importers can opt-out.

HMRC will publish the following information, for any business who is UK VAT and or EORI registered and imports goods from EU to GB.

- importer’s name and address

- commodity code imported

- description of the commodity code

- month and year of import

The release of this importer information:

- provides greater visibility of UK importers to new customers in the global market place

- assists developers to create importer registers and online shop fronts to advertise and showcase UK importers and their products

- enables those who provide import services to more easily identify their customers

We will not publish:

- national strategic and sensitive information, such as armaments importers and their products

- commercially sensitive information, for example where there are few importers of a given product where actual levels of trade could be identified or deduced

- details of markets, customers and market share

If you want your importer information excluded, for whatever reason and at any time, contact uktradeinfo@hmrc.gov.uk providing your business name and VAT number and or EORI number.

Please note: a request to exclude your business from the importer information sent to us by the 15th day of the month will mean removal from the information published the following month. For example, if you send in your request by 15 February 2022, we will make sure your information is not published in the January 2022 publication which is released on 11 March 2022.

However, this cannot apply retrospectively so we will not be able to remove information on importer information already published.